The News

The UAE has cemented its position as the leading IPO market in Europe, the Middle East, and Africa this year with the record-breaking listing of Talabat Holding in Dubai: The unit of Germany’s Delivery Hero raised AED 7.5 billion ($2.04 billion), making it the largest tech IPO globally this year.

Priced at the top of its range, with trading set to begin on Dec. 10, Talabat puts the UAE on track to raise more money through IPOs than any other country in EMEA for the third year running, according to Dealogic data.

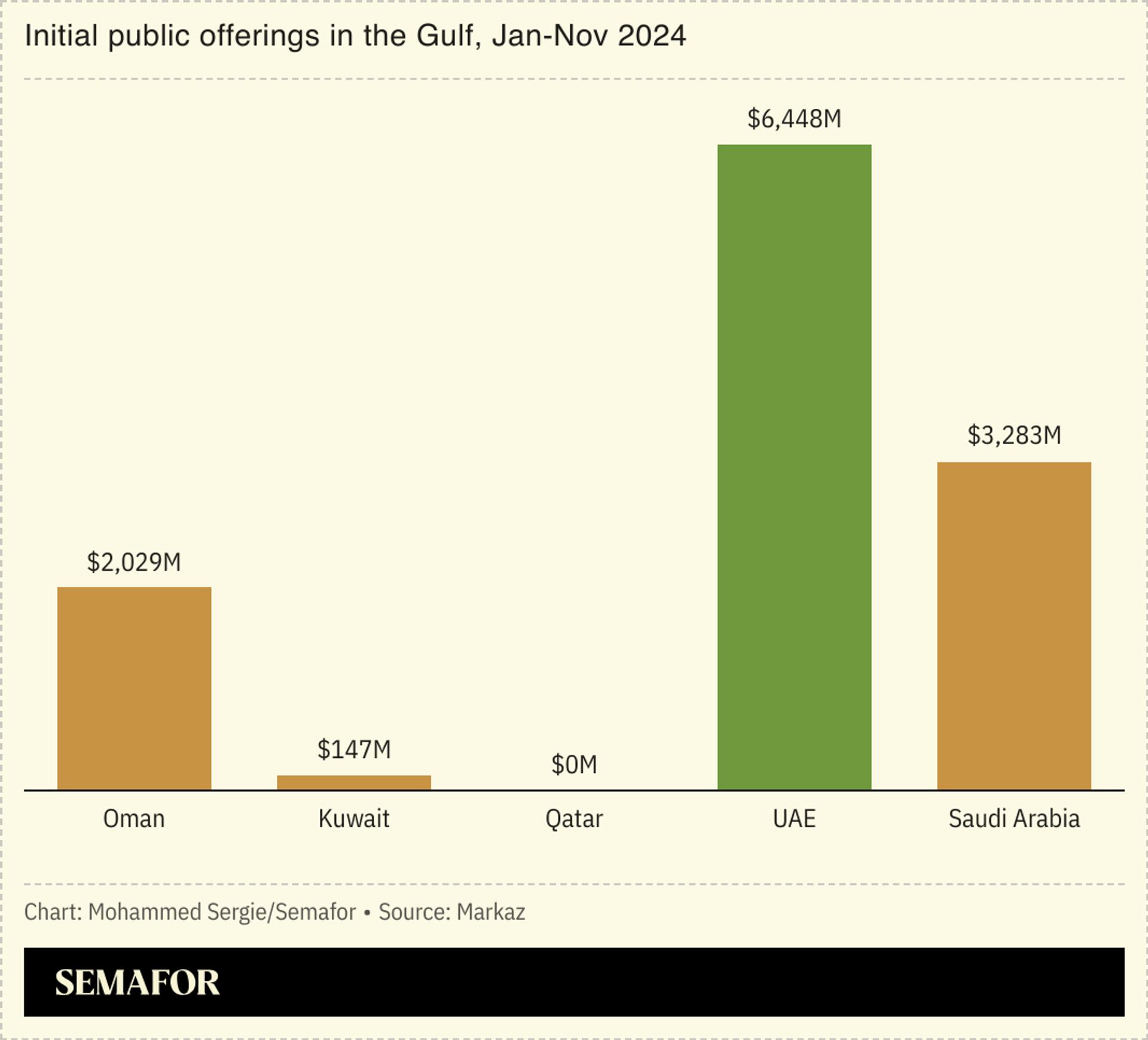

The Gulf region as a whole has outperformed global markets, with 45 IPOs raising $11.9 billion in the first 11 months of the year.

In this article:

Melissa Hancock’s view

Though the Gulf has led the way when it comes to the number of IPOs, many of those listings have performed poorly, largely because they are priced at higher earnings multiples, leaving little room for further gains. UAE’s Lulu Retail Holdings’ raised $1.72 billion when it launched — attracting $37 billion demand — but closed flat on its debut in Abu Dhabi last month. Similarly, Oman’s OQ Exploration & Production’s $2 billion listing fell 8% in October, and supermarket chain Spinney’s is trading near its offer price six months after listing.

Room for Disagreement

Despite the muted performance, Gulf markets have a robust IPO pipeline of companies across a diverse range of sectors. Analysts say demand, particularly for Dubai listings, remains strong amid the healthy expansion of the emirate’s non-oil sector. The UAE governments’ push to unlock value in state entities by divesting some of their holdings is also ensuring a steady flow of deals.

Talabat is just one of a growing number of regional private companies choosing to sell shares. An additional 11 private companies across various sectors, as well as five funds, plan to list on the regional exchanges by the end of this year, according to EY.