The News

CAPE TOWN — Africa’s top investors have been through one of their toughest periods raising funds over the last 12 months and are feeling intense pressure to back climate investments.

Speaking earlier this month at the Super Return Africa event, several leading investors told Semafor Africa that climate would be a priority. “Climate will be one of the key focus areas for investors in 2025,” said Wale Adeosun, CEO of Lagos-based Kuramo Capital Management.

But some senior private equity and venture investors told Semafor Africa privately that they felt pressure to include climate investments in their presentations to potential or current limited partners. They said Western development finance institutions — a large source of funds — have been keen to encourage investments in this sector.

“It’s a double-edged sword,” said one Ghana-based investor, who asked not to be identified because their firm was still raising a fund. “We agree with the principle of supporting climate investments, but we have so many problems to address in Africa that we need to prioritize.”

In this article:

Know More

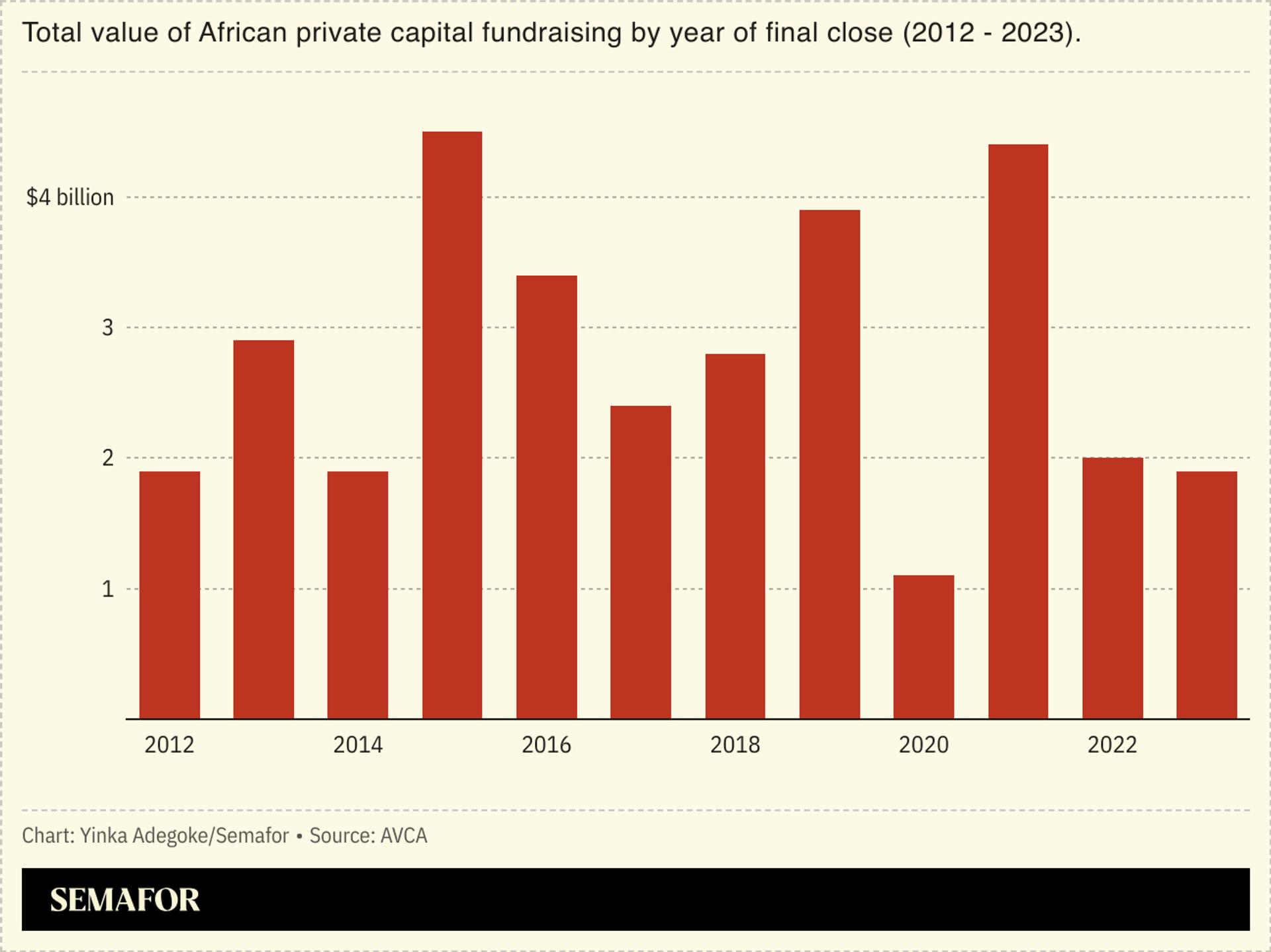

Last year Africa-focused private capital fund managers raised $1.9 billion, a 9% drop from 2022. Fund managers said 2024 had, anecdotally, been another tough year but remained optimistic about 2025. The tough environment means more are updating their decks to include impact investments and prospects to attract capital from DFIs.

The DFI sector led by the World Bank, British International Investment, and others has been keen to encourage green investment, such as clean tech and sustainable agribusinesses.

”The predominant capital from external organizations like DFIs is targeting themes along climate and impact despite the stats showing that, as a continent, Africa has the least emissions,” said an East Africa-based venture investor, who asked not to be identified. “It’s a classic case of ‘he who pays the piper calls the tune.’”

Yinka’s view

While many investors are excited about their impact on the continent’s development, building funds in the current macroeconomic environment remains a common challenge. Nearly everyone, from first-time venture capital fund managers to veteran private equity general partners, told me it’s been tougher than usual over the past 12 months.

To be clear, it’s not just climate investments that are on the table for 2025. As Kuramo’s Adeosun told me, there’ll also be more interest in agribusiness, fintech and healthcare. But climate or green investments which back companies or funds in areas like solar, wind energy or green infrastructure projects have the edge.

The concern, from those I spoke with, is that a chronically underfunded region has too many fundamental challenges to make green investing a primary focus. One fund manager privately questioned whether there was a sufficient “green pipeline” of investible opportunities, even while acknowledging the disproportionate impact of climate change on Africa.

It’s worth noting that this could all change again over the next 12 months as a Trump effect starts to kick in. The recent DFI-led push for green investment projects has roots in the US Inflation Reduction Act which President Joe Biden signed into law in August 2022.

It won’t be surprising if there’s a perceptible shift away after Donald Trump moves into the White House next month. His administration is likely to place a lot less emphasis on green projects and there will be a trickle down effect seen with the influential US-led institutions in the development finance space.

Room for Disagreement

Alitheia Capital’s Tokunboh Ishmael, who’s raising a $200 million fund focused on the intersection of climate, digital transformation and gender, argued that climate investments aren’t a ‘nice to have.’ She said investors need to think more about investing in clean tech that helps “drive down the costs” of energy access for everyday Africans.