The News

A top US energy expert thinks the Biden administration missed the mark in its long-awaited study of US natural gas exports, arguing that pushback on a key element of President-elect Donald Trump’s fossil fuel ambitions will end up hurting the economy.

The Department of Energy study, published Tuesday, casts expansion of the liquefied natural gas industry as a dire economic and environmental risk, warning that such a move would cause domestic energy prices and global greenhouse gas emissions to spike. Maintaining the current pace of exports is “neither sustainable nor advisable,” said Energy Secretary Jennifer Granholm.

But Daniel Yergin, vice chairman of the research firm S&P Global and a preeminent energy historian, disagrees. In a lengthy analysis of the US LNG market, Yergin and his colleagues argue that expanding LNG exports is an unalloyed boon to both the US economy and national security. He told Semafor that holding back the sector will cost the US tens of thousands of jobs, empower Russian President Vladimir Putin, and slow the pace of decarbonization in coal-reliant countries in Asia.

In January the DOE, under pressure from climate groups, temporarily stopped issuing permits for new LNG export terminals until it could decide whether continued growth of the industry — the US is now the world’s top LNG exporter — was in the national interest.

In this article:

Tim’s view

The DOE report is a parting shot from US President Joe Biden aimed at defending his legacy against Trump. Approving the half-dozen new LNG terminals that were held up by the Biden administration — especially the massive Calcasieu Pass 2 project in Louisiana — will likely be an early priority for Trump. Tuesday’s report won’t stop the new administration from doing that. But it could delay the process by as much as several quarters, the consulting firm ClearView Energy Partners said. And in the meantime, it will provide ample fodder for the inevitable barrage of lawsuits from environmental groups opposing new LNG terminals.

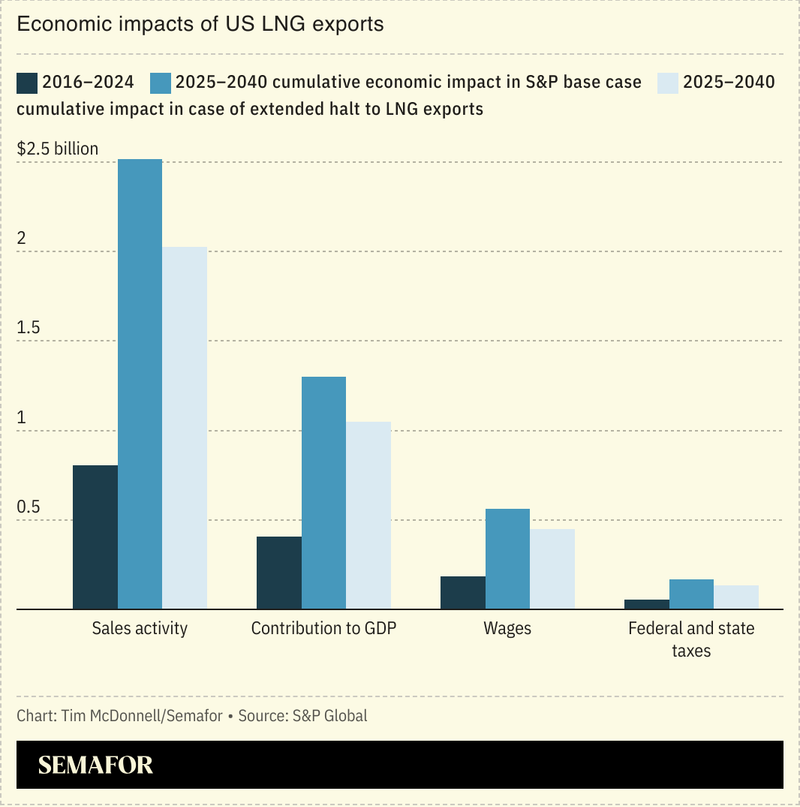

Yergin’s analysis, meanwhile, shows where the other side of the LNG battle lines will be drawn. If all of the LNG projects currently in the works are approved and built, the S&P study concludes, they would add about $1.3 billion to US GDP and become one of the country’s most valuable exports.

One high-stakes point on which Yergin and the DOE diverge is the extent to which importers, particularly in Europe and Asia, still have an appetite for US LNG. The DOE report sees the European market reaching saturation soon, while in Yergin’s view there’s still room for growth. And when it comes to China, the world’s top LNG importer, Trump may find that his goals of imposing punishing new tariffs on the country and expanding the customer base for US LNG are at odds.

The View From Daniel Yergin

This interview has been lightly edited for length and clarity.

Tim McDonnell: Your outlook on US LNG exports is quite different from the DOE’s. What’s behind that disagreement?

Daniel Yergin: I have a lot of respect for Secretary Granholm and the DOE. But we just have come to very different conclusions. We see US LNG being very important to supply both Europe and Asia. And the economic benefits are really tremendous. What really surprised me is the scale of this business. Take the two most contentious issues in US-Chinese trade, semiconductors and soybeans. The value of LNG is half the value of all our semiconductor exports, more than soybeans, and my favorite is that it’s twice the value of Hollywood and television exports. So this is a very significant business, and the benefits go across the country. And the US gains enormous political significance, because Europeans and Asians really want to be able to count on the United States as a reliable supplier.

And you don’t see that global demand changing anytime soon.

The energy transition is very uneven. This year Europe will have only added about 4% to its solar capacity. So maybe [DOE is] making different assumptions about the speed of the energy transition. But I think you need to look at what’s actually happening. Europe is not going to rush to import Russian gas. Without US LNG, the coalition supporting Ukraine could not have held together and we might be looking at a different outcome today in Ukraine. The US doesn’t exist in a vacuum. We came to the conclusion that if US LNG exports are curtailed, 85% of that curtailment will be replaced by fossil fuel sources from other countries, some of whom might write thank-you notes to the United States for opening up the market to them.

What about the risk that higher gas exports raise domestic gas prices? You don’t seem as concerned about that as the DOE.

LNG exports have grown a lot, but the volumes of gas production have been three times as great as the LNG supply. The US has very abundant natural gas resources, and when we analyze the impact on the domestic gas price, the impact was negligible, like 1%. The US has a tremendous economic advantage from having cheap gas. Our residential gas prices are half that of Europe. And when we look at the resource base, we think we’re going to continue to have cheap gas for a very long time.

Carbon emissions aren’t really addressed in this report, but what’s your sense at this stage of how US gas exports could help or harm net global emissions?

We want to do a comprehensive study on emissions, but the main reason US emissions have gone down is because gas has replaced coal in US electric generation. So gas is a very effective way to replace coal. One of the main drivers of LNG exports is to Southeast Asia, to replace coal [in the power sector there]. Last year, coal consumption reached its highest level ever, and this year, we think it will once again reach its highest level ever.

But you think there’s more room for coal-to-gas switching in Asia.

Big time. The fact that global coal demand is going up tells you that it’s being burned somewhere, and a lot of that is in Asia.

What do you expect to see from the Trump administration on LNG, and do you think this new DOE report will complicate that?

I think we’ll see a pretty decisive change. Trump was a big proponent of LNG, and I think in general, their message is going to be about rolling back regulations, which I think will be supportive of LNG exports. But clearly the Biden administration, on its way out, wanted to put down a marker. How it proceeds is going to be thrashed out in federal courts.

And in the meantime, do you still see a lot of eagerness from Wall Street to finance new LNG projects?

Absolutely. If the exports double, which is slated to happen, this will be equivalent to all US semiconductor exports. One of the things that’s just not understood is how it’s quite remarkable to have an industry that only began in February 2016 to become one of our major export industries, and to have this level of global influence.