The News

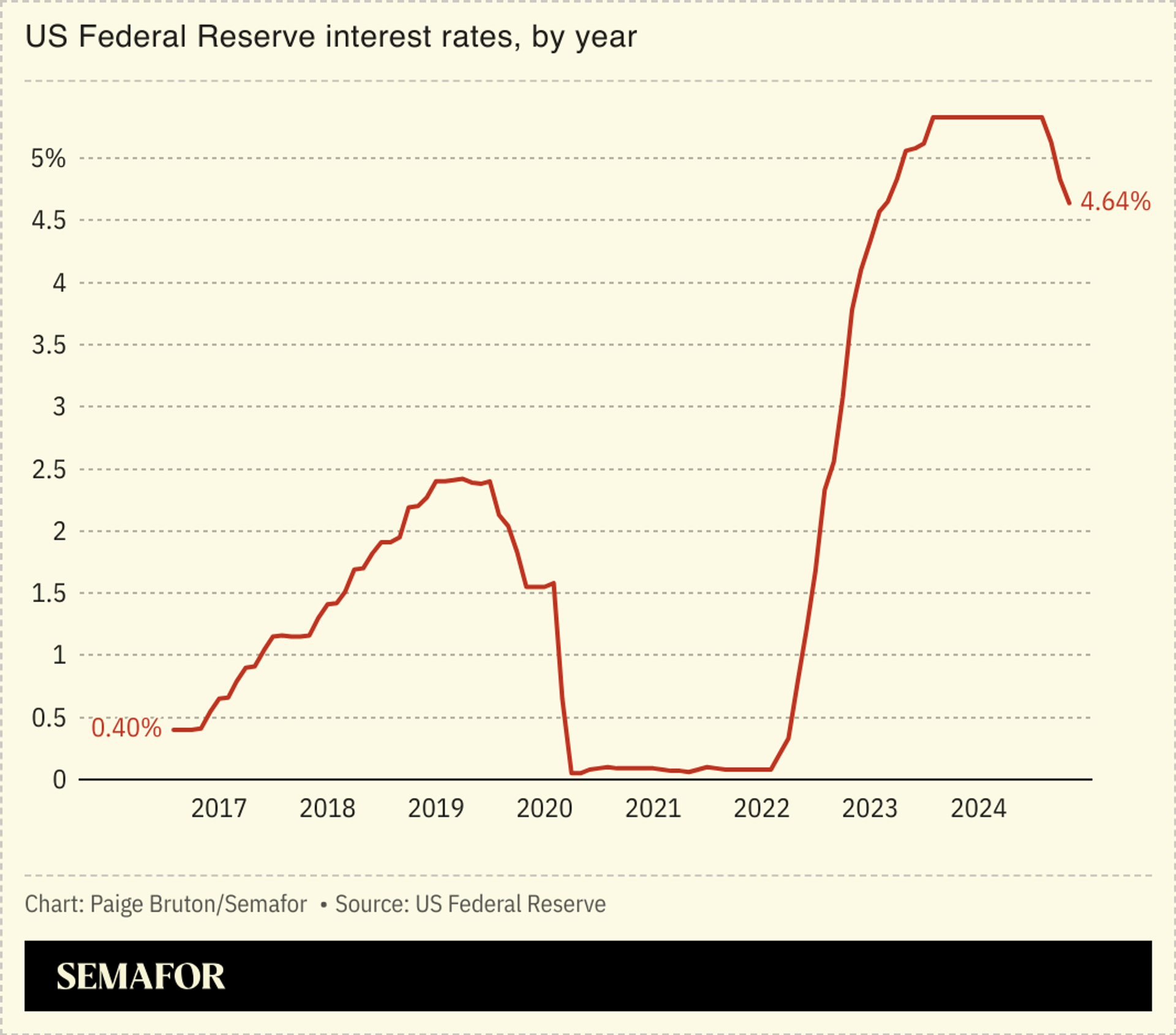

The US Federal Reserve is expected to cut rates on Wednesday in its final interest rate decision of 2024, but traders and economists were divided over future monetary policy.

The widely anticipated 0.25-percentage-point reduction — a third consecutive lowering — is already being overshadowed by debates over the implications of US President-elect Donald Trump’s policies, The Wall Street Journal’s chief economics correspondent wrote. The conversation is also centered on how close the Fed is to the “neutral” rate, where monetary policy neither drives nor drags economic growth.

Experts see varying paths of between a half and a full percentage point of cuts next year. Even minor changes will have major implications for debt-reliant industries such as renewables, as well as countries worldwide that borrow in dollars.