The Scoop

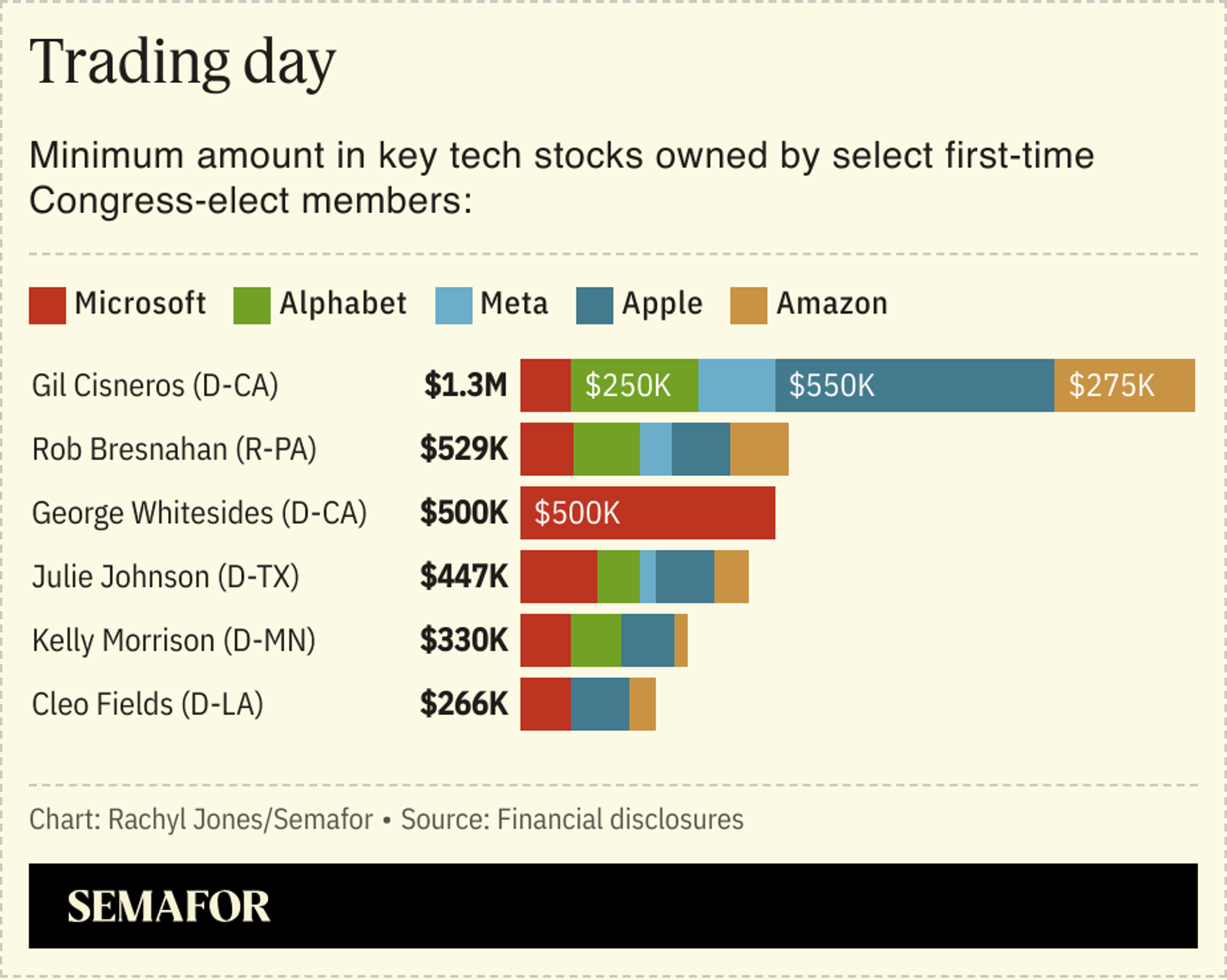

Congress-elect members taking their seats for the first time in January own at least $3.8 million — and as much as $9.1 million — in key tech stocks, financial disclosures show.

Elected members report their stock ownership, and that of their spouse, in ranges rather than exact numbers, so the precise amounts aren’t publicly known. Still, the multimillion-dollar figures reveal how the new members’ stock portfolios could benefit from the policies they will have a hand in molding.

With companies racing to develop the largest and most advanced AI models, the coming years are critical in shaping the future of tech regulation. Congress must balance privacy and safety concerns with rules that still allow the US to maintain its lead in AI innovation over China.

Gil Cisneros, a California Democrat elected to the House, leads the group with between $1.3 million and $2.9 million in holdings across Microsoft, Alphabet, Meta, Apple, and Amazon. Pennsylvania Republican Rob Bresnahan and Texas Democrat Julie Johnson (with her spouse) own as much as $1.4 million and $1.2 million, respectively, across the five stocks.

Some sitting and former Congressional members — and their family members — own far more in tech shares. The husband of former Speaker of the House Nancy Pelosi has famously loaded up on stocks, with his Apple shares alone worth more than $25 million. Pelosi does not own any stocks herself, her spokesperson told Semafor.

In this article:

Know More

Members of Congress are not required to divest their stocks in industries they oversee, but they are expected to avoid conflicts of interest and cannot trade on nonpublic information. President Joe Biden, as well as other lawmakers and advocacy groups, have pushed for stricter rules.

“Nobody in the Congress should be able to make money in the stock market while they’re in the Congress,” Biden said in an interview recently.

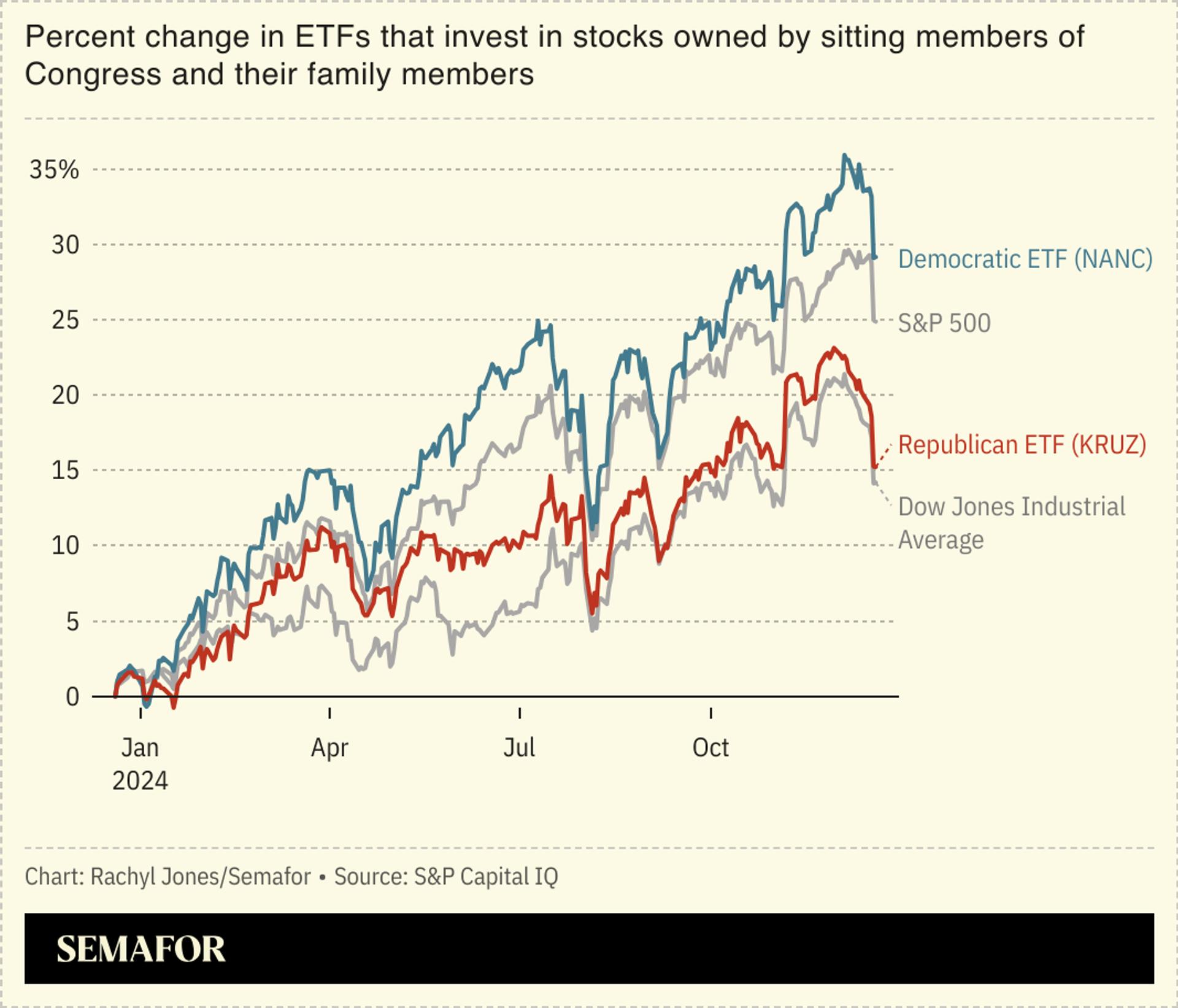

Funds that hold similar portfolios to sitting members of Congress outpaced the Dow Jones Industrial Average’s growth this year. The tech-heavy ETF aligned with Democrats’ holdings beat the S&P 500.

Correction

A previous version of this story misstated Pelosi’s holdings of Apple shares as her own when the stock is part of her husband’s portfolio.