| The push by regulators and shareholders for corporate carbon accounting is creating a new digital vu͏ ͏ ͏ ͏ ͏ ͏ |

| Tim McDonnell |

|

Hi everyone, welcome back to Net Zero.

Big Oil’s consolidation wave is running out of targets.

When Texas-based oil producer Diamondback acquired its slightly-smaller neighbor Endeavor this week for $26 billion, it managed to snap up one of the last large private oil companies on the market. To do so, it reportedly had to outbid ConocoPhillips. A big motive for this consolidation is the gloomy outlook for global oil demand, as my colleague Liz Hoffman wrote this week: With the pie not getting any bigger and ultimately destined to shrink, oil producers are scrambling to find efficiencies and cut their drilling costs on the theory that the cheapest barrels to produce will survive the longest.

ConocoPhillips is now the last big potential buyer, but there’s not much left for it to buy. Texas-based Mewbourne and Oklahoma’s Continental Resources are the only midsized private companies in the Permian shale basin with an inventory big enough to make an interesting acquisition target, and neither is for sale. One option is that smaller companies like Ovintiv, Coterra, and Civitas could “join forces” in the interest of getting to a more competitive scale, Rystad Energy said in a note.

Another possibility is that the buyer becomes the bought: Diamondback itself is now a possible acquisition target for Conoco, Exxon, or Chevron, said Rob Thummel, managing director at the energy investment firm Tortoise. It just depends how much spending those companies’ shareholders are willing to tolerate on expanded drilling given the uncertain pace of the energy transition.

If you like what you’re reading, spread the word.

- Offshore drilling lawsuits

- Love ain’t cheap

- Hackers hit climate data

- Trump’s oil cash

- Permitting progress

Shell’s climate tech play, and its LNG prognostications. |

|

Offshore drilling lawsuits |

REUTERS/Kevin Lamarque REUTERS/Kevin LamarqueJoe Biden’s climate agenda is under legal attack by both ends of the political spectrum. This week, the administration was hit by a pair of lawsuits over its record-low offering of offshore drilling leases. One filed by the American Petroleum Institute complains that not enough drilling is being permitted, and that the administration’s leasing program is “arbitrary, capricious and not in accordance with the law.” Meanwhile, a suit led by the activist group Earthjustice makes the opposite claim, arguing that any new lease sales at all jeopardize the health of Gulf Coast residents. Neither suit is likely to be resolved before November, so the outcome of U.S. drilling policy will still likely be decided at the ballot box, not the courthouse. |

|

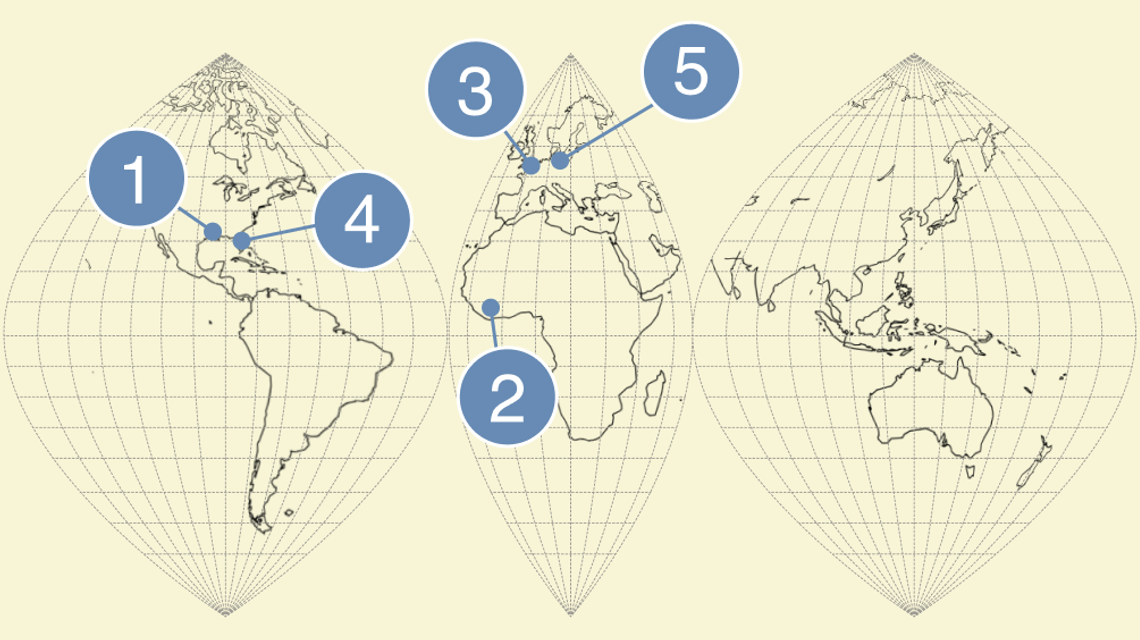

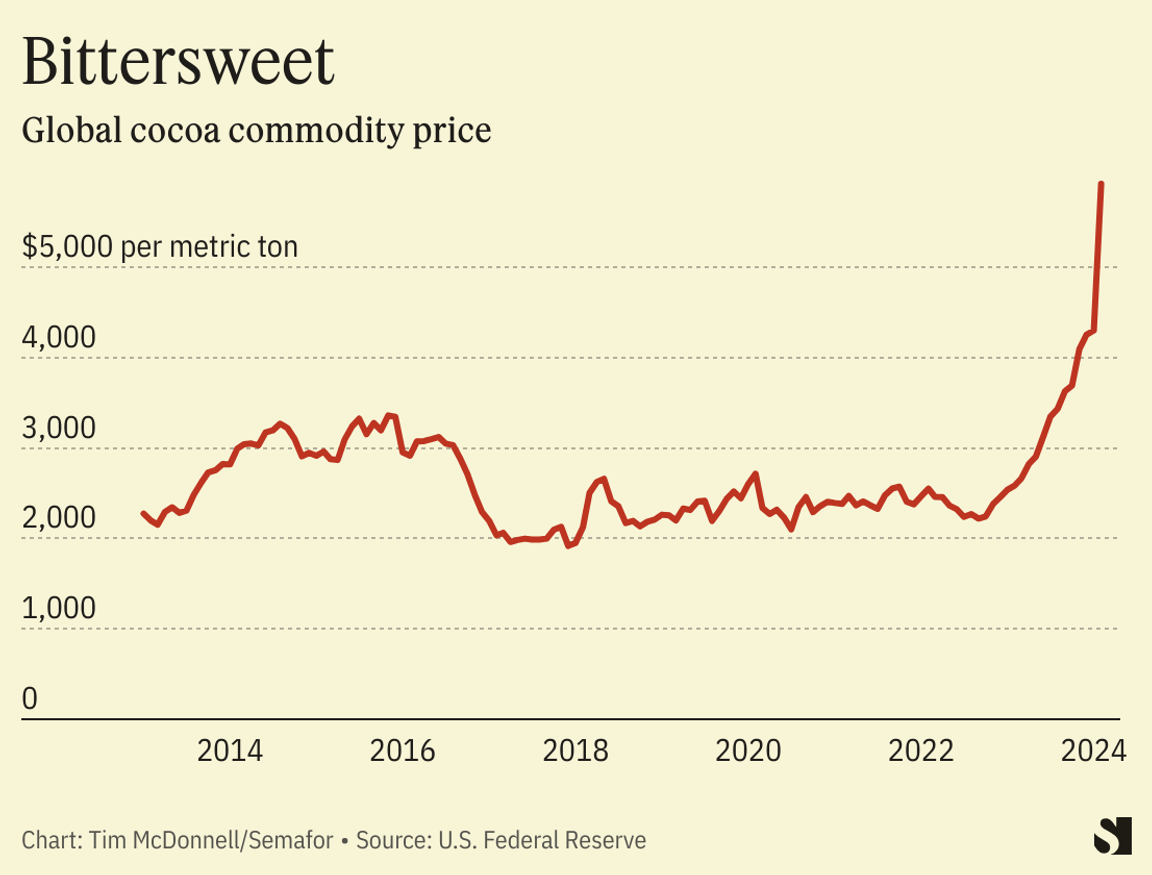

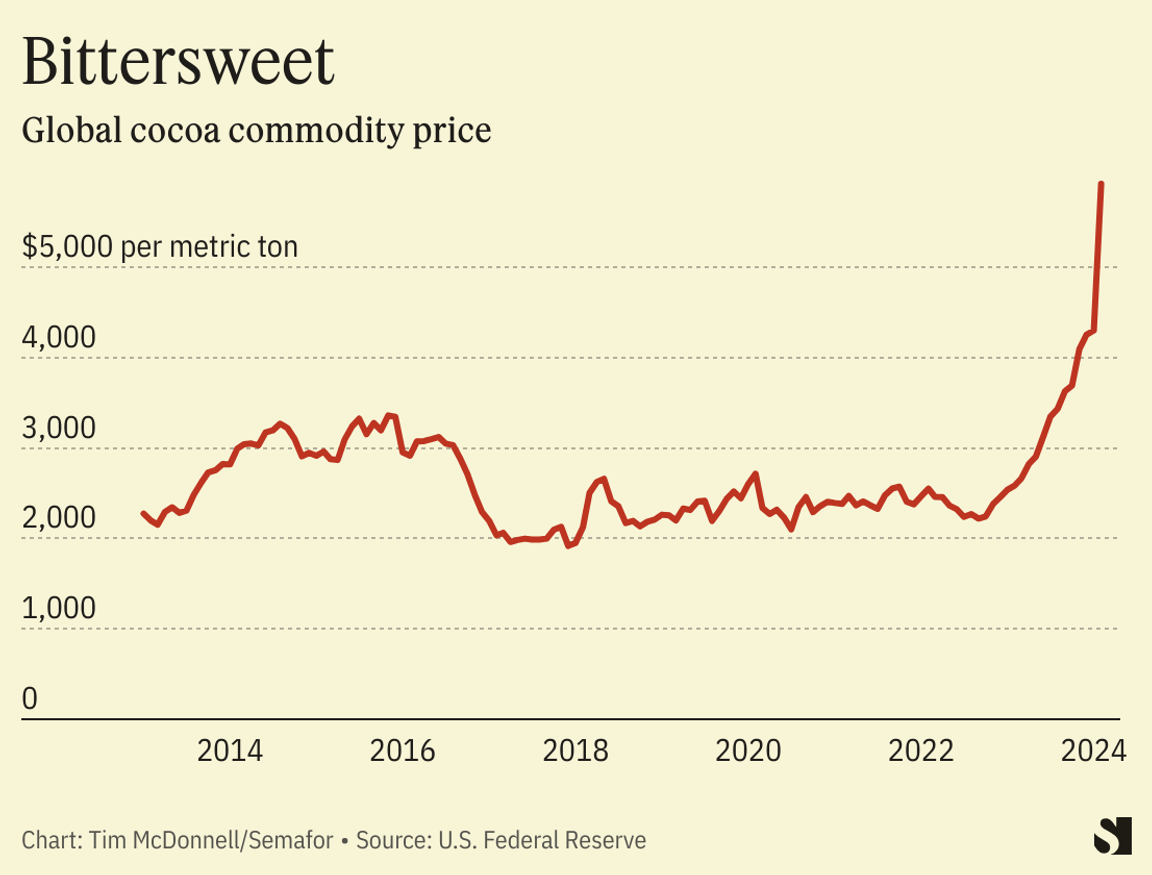

Climate change is making Valentine’s Day dates more expensive.  Cocoa prices are at an all-time high, thanks to uncharacteristically dry conditions in the West African countries that produce 60% of the global cocoa crop. Analysts at Citi think prices could surge far higher, potentially passing $10,000 per ton in the next few months, and the CEO of chocolate maker Hershey’s said its shareholders should expect slim profits in the year ahead. Conditions could improve next year, as the El Niño cycle fades. Roses, too, are at risk: An analysis this week by S&P Global projected that the number of days with extreme heat conditions in Colombia and Ecuador, the top rose-exporting countries, will double by 2050. |

|

Pexels PexelsHackers are opening a new front in the corporate cybersecurity wars by hijacking the torrent of sensitive climate and energy-related data streaming out of companies. In January, the consulting firm Schneider Electric was hit by a ransomware attack on its Sustainability Business division, which helps client companies track their emissions, improve their energy efficiency, and source renewable power, among other services. The attack took some of the division’s essential software offline for two weeks, during which an undisclosed volume of client data was compromised. A Schneider spokesperson declined to specify what exactly was stolen (or answer any questions beyond a terse press release), but the main program that was hit manages clients’ energy-use data, including emissions estimates, utility invoices, and facility-level information that is more detailed than what companies typically make public. Schneider declined to say whether it paid a ransom to retrieve stolen data, but for now the episode appears to be over. The company said it is investigating and plans to take “additional actions” to improve its cybersecurity. The attack on Schneider illustrates a new vulnerability for companies already facing pressure from regulators and shareholders to track and curb their emissions. Businesses are compiling more energy and climate data than ever before, which have the potential to reveal sensitive details of their operations and embarrassing facts about their environmental footprint. And they’re often sharing it with a proliferation of third-party accounting and consulting firms: Schneider itself is developing decarbonization plans for at least one-third of the Fortune 500. Climate data needs a security upgrade, or companies’ willingness to tackle their emissions could be curtailed. |

|

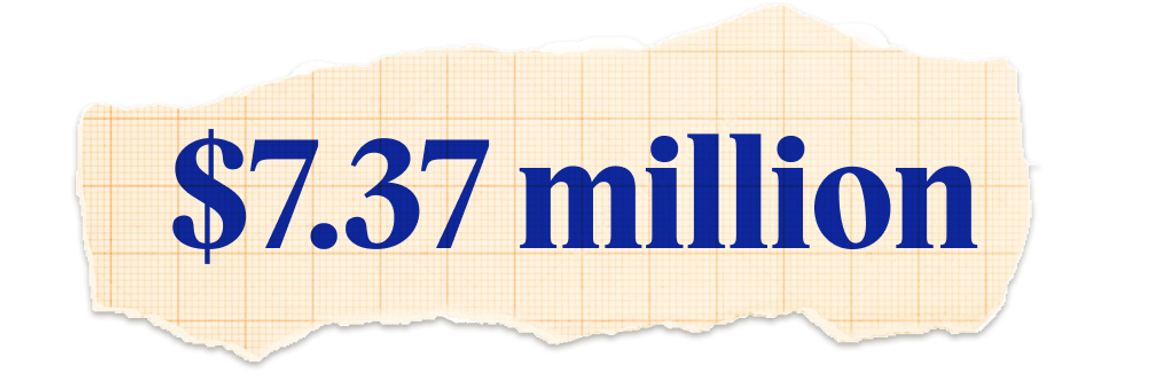

Oil and gas industry donations to Donald Trump’s reelection campaign. That’s 11 times more than the industry has given to reelect Joe Biden, and makes fossil fuels one of Trump’s top campaign backers, according to Bloomberg. But if Trump is elected, his immediate options to pump up U.S. oil production — already at record highs, and predominantly a factor of global price trends, not White House policy — will be limited. |

|

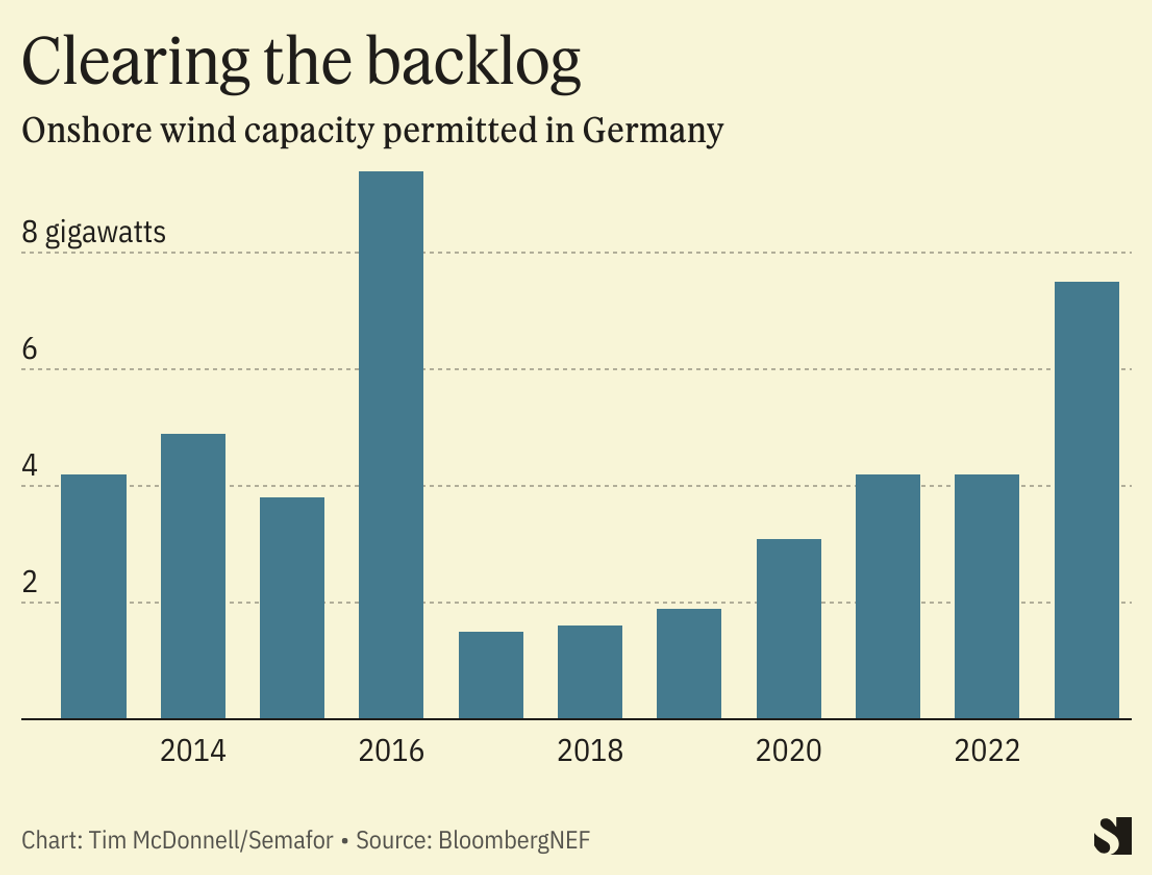

Europe’s permitting progress |

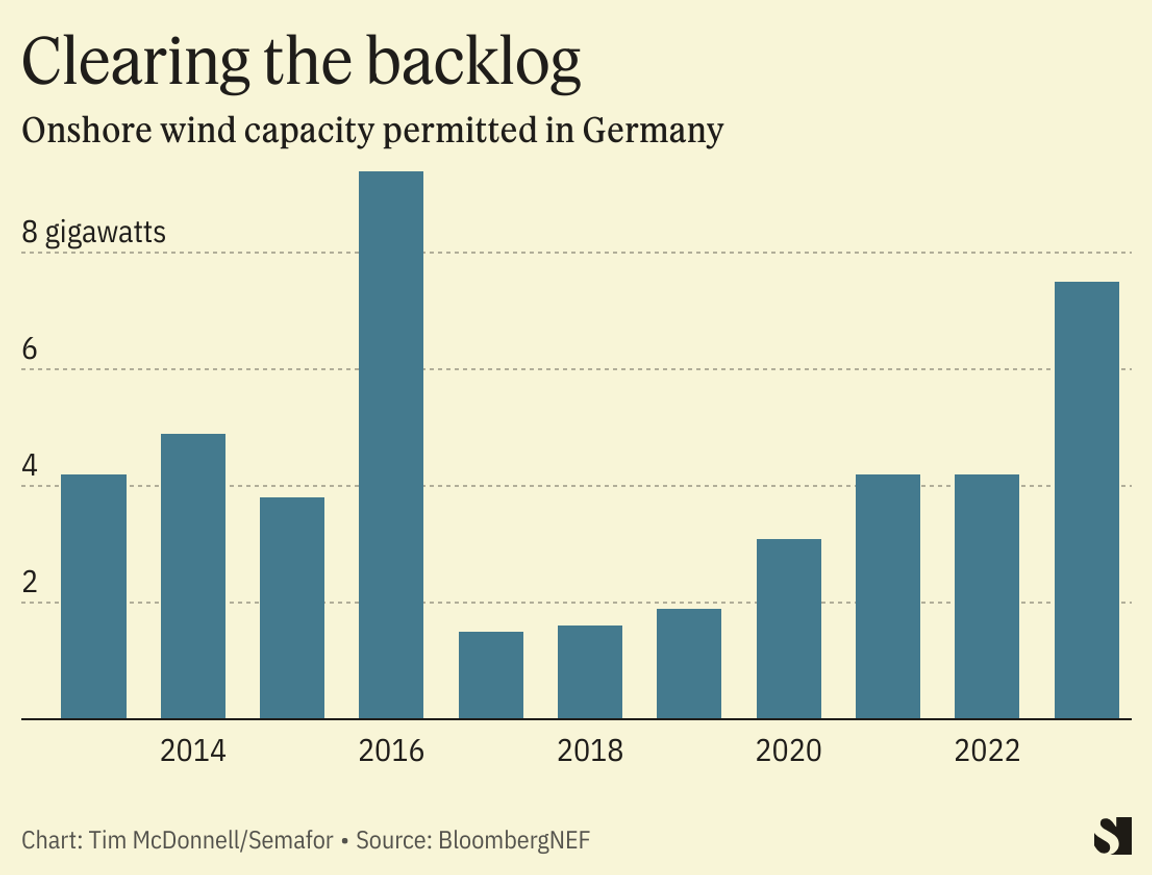

Europe is starting to break through the logjam on issuing permits for renewables infrastructure, one of the tightest bottlenecks of the energy transition.  By declaring some clean energy projects to be in the national interest, European countries are speeding them through the permitting process, according to an analysis this week by BloombergNEF. In Germany, wind permits jumped 80% in 2023 from the year before. But there’s still a long backlog to clear out, with seven times as much wind power capacity in the permitting queue for Europe’s top five energy markets as those countries approved last year. Comprehensive electric grid permitting reform remains politically elusive in the U.S., meanwhile. But a new report from the think tank Rewiring America lays out a few steps that utilities and regulators can take to connect more renewable energy to the grid at the lowest cost and with the least bureaucracy. That includes changing the way utilities price electricity to incentivize them to choose lower-cost sources of power and allowing more electricity to flow through existing wires. Utilities should also make better use of AI software, the report recommends, to make small adjustments to homeowners’ thermostats, water heaters, EV chargers, and other grid-connected hardware, which can be used to reduce demand peaks and store power at times of low demand. |

|

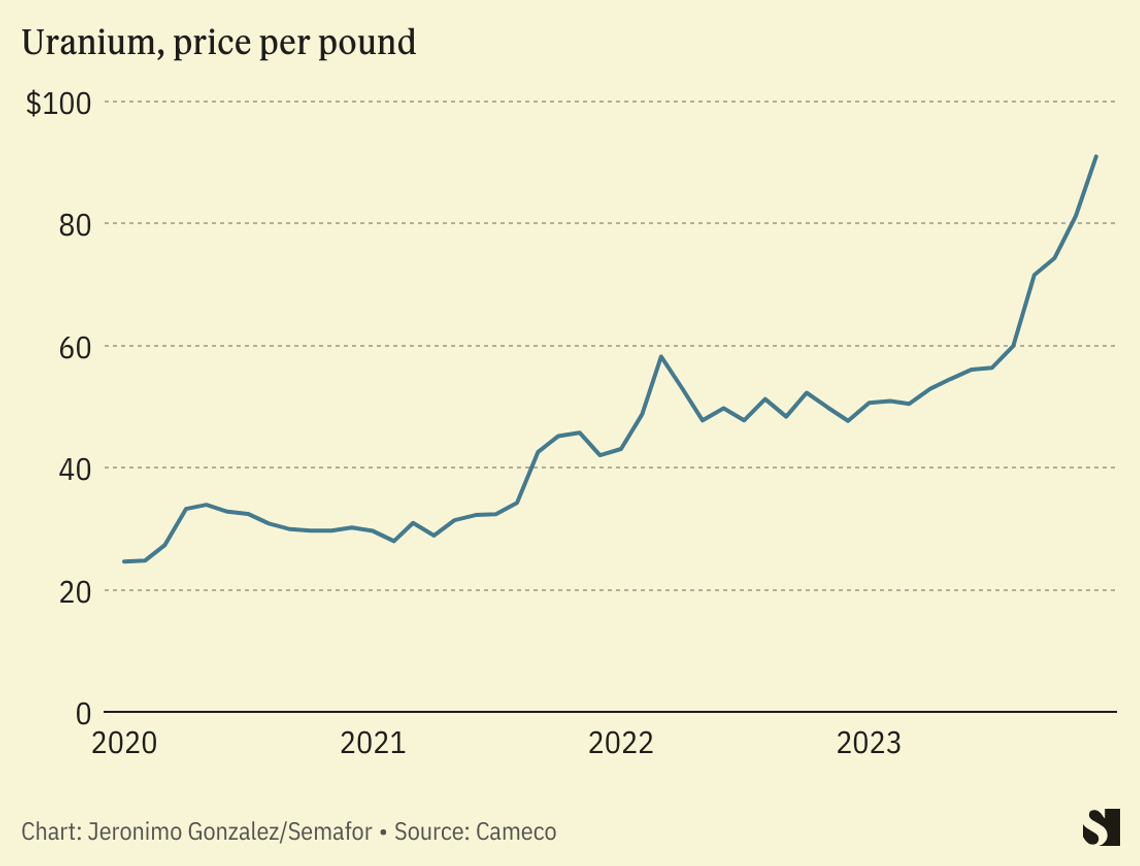

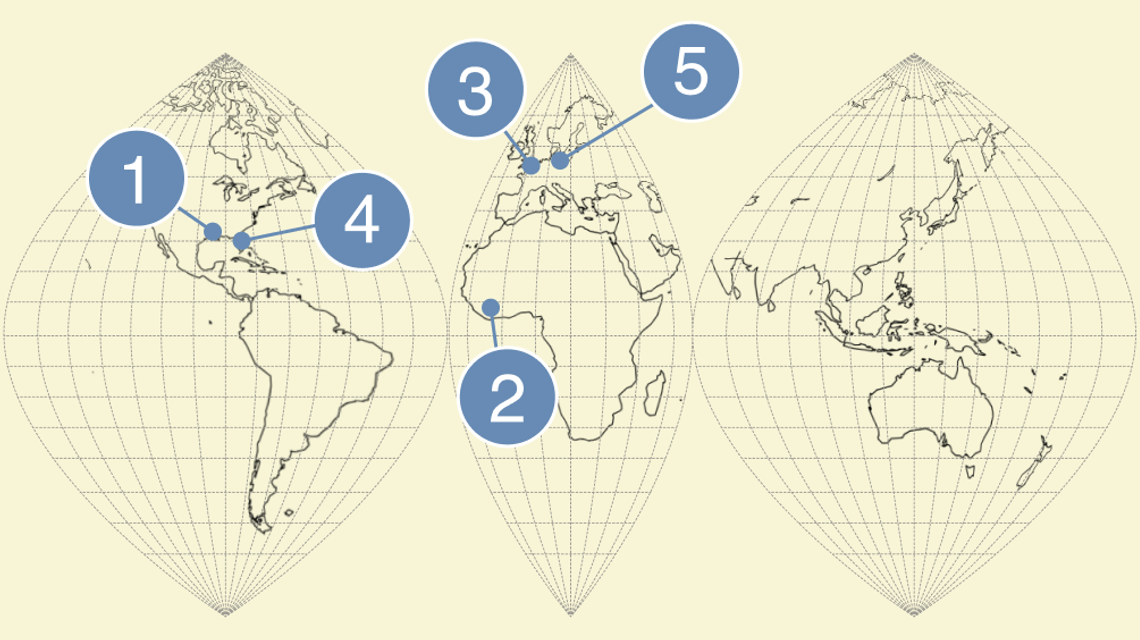

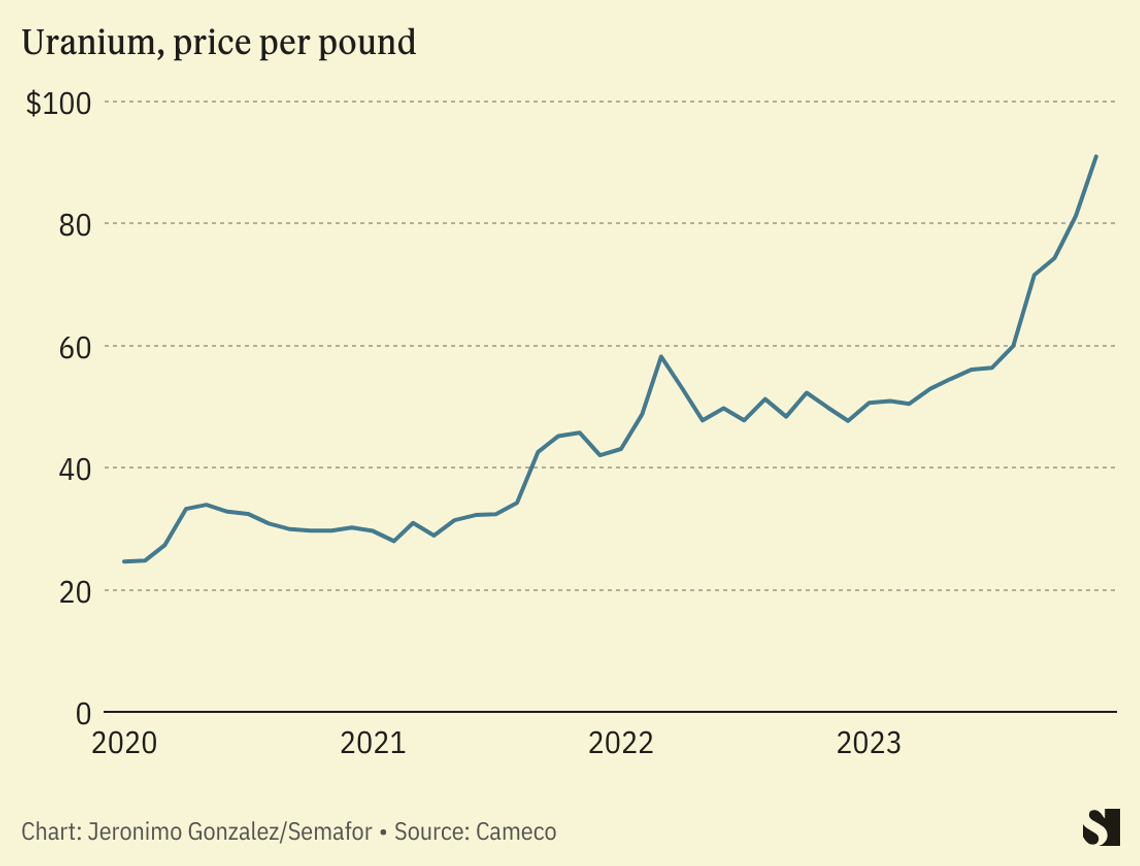

New energy - The top supplier of uranium to U.S. nuclear power plants said there is plenty of the material on hand to completely sever imports from Russia. The Biden administration, which had previously been reluctant to ban Russian uranium for fear of destabilizing U.S. nuclear power production, now supports Republican-backed legislation to do so that passed the House in December and could become law this year.

Fossil fuels- Shell slightly lowered its forecast for future liquified natural gas demand. LNG demand could increase up to 70% between now and 2040, according to the latest outlook from the company that controls the world’s largest LNG portfolio. That’s more bullish than the International Energy Agency’s forecast, which sees LNG demand peak by 2030.

- More of that LNG is going to come from Mexico. While the U.S. has hit pause on new export terminal permits, Mexico is steaming ahead with an Asia-facing port that was originally meant to import gas but will now be a major outlet for U.S. exports.

- Austria is trying to speed up its divorce from Russian pipeline gas. The country is among the most reliant in Europe on Russian gas, which delivered 98% of its supply in December. A proposed law would make it easier for importers to shake off those contracts, but could lead to a lengthy legal battle.

Finance- HSBC will expand how it tallies its carbon footprint, to include some forms of financing it had previously ignored. The bank will now include emissions linked to capital market deals it arranges on behalf of fossil fuel companies, rather than only its own direct lending. Climate finance activists have long complained that most banks ignore this type of financing, even though it’s a major source of emissions.

- BlackRock’s ESG funds have drawn a net inflow of investors every quarter for the last two years. Despite attacks from Republican lawmakers and an overall outflow from ESG funds across the market, BlackRock’s ESG-labeled funds have performed well — in part because they are heavily weighted into tech stocks.

Tech- Google will lend AI computing power to a soon-to-launch satellite that will hunt methane emissions around the globe. MethaneSAT, which is backed by the Bezos Earth Fund, will be the most sensitive emissions detection hardware in space; Google’s role will be to crunch all the data it collects, the company said Wednesday.

- Scientists are pressing ahead with pilot-scale geoengineering projects that have long been seen as too risky. The projects include modifying clouds to shade the Great Barrier Reef and dumping 6,000 gallons of chemicals into the ocean off Martha’s Vineyard to lower marine acidity.

EVs REUTERS/Mike Blake REUTERS/Mike Blake- Tesla cut its prices again, dropping $1,000 from the price of its Model Y in the U.S. CEO Elon Musk said the cut is because “people don’t love to buy cars in the middle of winter” and warned that the price could jump back up again in March.

- The biggest Chinese EV battery makers are joining forces to develop solid-state batteries, which would be able to hold a much longer charge than conventional lithium-ion batteries.

COP29- Azerbaijan froze new hotel bookings in Baku during the dates of COP29. High prices and room shortages were a problem during COP27 in Egypt, and a barrier for many activists and delegates from low-income countries.

|

|

Jeff Allyn, CEO of Onward, a climate tech company incubator launched last week by the oil and gas major Shell.  |

|