| In this edition, a new AI-powered financial research tool with backing from famed investor Steve Coh͏ ͏ ͏ ͏ ͏ ͏ |

| Reed Albergotti |

|

Hi, and welcome back to Semafor Tech.

The Trump administration believes its tariffs will create jobs in the US and I totally agree. They will create jobs for robots.

Rising consumer prices, tariffs, and deportations of an already depleted workforce are perfect conditions for a robotics boom.

On Tuesday, White House spokeswoman Karoline Leavitt told reporters the president believes even iPhones could be made in the US.

The tech industry knows that’s ridiculous. The iPhone supply chain, now subject to tariffs, is spread out all over the world, and would take many years and a herculean effort to replicate in the US. By the time it happened, the devices might not even be a thing anymore.

What the Trump administration probably means is that the final assembly of iPhones could be done in the US. But that would be nothing to brag about: iPhones are not automobiles, and putting them together is not a good job — even in China.

A source once talked to me about setting up Apple’s assembly lines. The best workers were young girls, because they have dexterous, small hands. It was work poorer kids would do in order to save some money before attending school. They didn’t see the tedious, stressful work as a career. Young American girls are unlikely to spend a summer or a year making minimum wage in an iPhone factory.

If iPhone City were moved to Alabama, the assembly couldn’t be done with today’s robots. But we’re seeing major advances in that area. Within a couple of years, AI models could be good enough to perform complex maneuvers that today require human dexterity.

It would still likely cost more than employing a worker in places like China, Vietnam, and India. But cost might not be the driving factor. If it becomes untenable to assemble products anywhere but in the US, robots might be the only viable option in an America with a diminished labor pool.

Also: Read below for Rachyl Jones’ strange AI-powered dentist appointment, an exclusive on a new financial research tool from a company backed by famed investor Steve Cohen, and another exclusive on a first-of-its-kind carbon capture system connected to a data center.

➚ MOVE FAST: Twiddle your thumbs. The AI talent war is so hot that Google would rather pay employees to do nothing than see them join a rival, according to Business Insider. DeepMind is reportedly utilizing aggressive noncompete clauses for some employees in the UK, preventing them from joining a competitor for up to a year after their work at Google is done but still paying them during that time. ➘ BREAK THINGS: Whistle while you work. A former Facebook executive-turned-whistleblower will testify in front of Congress today that Meta lied to shareholders and Congress about its relationship to the Chinese Communist Party. The social media giant reportedly undermined US national security by briefing Chinese officials on emerging technologies, which helped the country build out its AI-powered military capabilities, NBC News reported. Meta disputes the account. |

|

Today’s flavor is mint. You can imagine my surprise when during a routine dentist appointment this week, an AI model scanning my X-ray images indicated that I had four cavities. But with a quick look, my dentist assured me that I did not, in fact, have any cavities at all. The model had picked up the natural grooves of my teeth and marked them as such, she said. AI is becoming integrated into every aspect of our daily lives, but the gaps in accuracy — when not mitigated by a human professional — can be a headache at the least and harmful at their worst. Had I relied solely on the AI model analyzing my X-ray images, I would be undergoing an unnecessary procedure and footing the cost of it. Sans insurance, the average cost of the most popular type of filling comes to roughly $200 per tooth, according to GoodRx.  Annabelle Gordon/File Photo/Reuters Annabelle Gordon/File Photo/ReutersWhile software can expand health care access in places where dentists and doctors are in short supply, my experience highlighted the lengths AI still has to go in producing accurate diagnoses at a time when experts are flaunting AI’s ability to replace human labor. Bill Gates recently said the technology will do the jobs of many doctors within 10 years. Dr. Mehmet Oz, who runs the Centers for Medicare and Medicaid Services, promoted AI avatars as a replacement for frontline health care workers during his first staff meeting this week, Wired reported. — Rachyl Jones |

|

An AI startup promises to make investment deals smarter, faster |

Brightwave co-founders Brandon Kotara and Mike Conover. Courtesy of Brightwave. Brightwave co-founders Brandon Kotara and Mike Conover. Courtesy of Brightwave.Investors across private and public markets are being buffeted by uncertainty. One AI startup, backed by Steve Cohen’s Point72 Ventures, aims to at least save them time by handling grunt research work so investors can focus on what matters: making money. Brightwave, a Colorado-based startup, launched a deep research tool for private market investors that reads business documents and produces a short report analyzing key data points, the startup exclusively told Semafor. To use the tool, investors upload documents — like proprietary financial records, board meeting minutes, shareholder agreements, and customer contracts — for companies in their portfolio or companies they are looking to fund. Then they input their research goals or questions they want answered — for example, clarity about the business model or risks. Brightwave’s system pulls relevant data points from the documents and produces a report with citations. |

|

| Carbon Capture Breakthrough |

Courtesy of Orbital Materials Courtesy of Orbital MaterialsOrbital Materials, a company founded by a former DeepMind researcher, is launching a first-of-its-kind effort to capture carbon by piggybacking off the hot air emitted by data centers. The pilot program, the company told Semafor exclusively, will use a new material that was designed with the help of artificial intelligence to work more efficiently in data center conditions. Orbital hopes Amazon — which is already a data center partner — and other hyperscalers will become customers for its new carbon capture technology. In the age of AI, data centers are consuming enormous amounts of energy, boosting emissions. Orbital Materials says the site of the pilot program, a data center in the UK operated by cloud computing company Civo, could do the opposite, resulting in a net reduction in carbon in the atmosphere. Direct air capture, which moves air through materials known as “sorbents,” can cost as much as $1,000 per ton of captured carbon. Jonathan Godwin, co-founder and CEO of Orbital, says early tests suggest the cost at the UK facility will end up being around $200 per ton. “That’s lower than what we expected,” Godwin told Semafor. The key factor, he said, is its new molecule, which looks like a purple powder and works at different temperatures than traditional sorbents, making it more suited for the unique conditions at data centers. “The integration of our ability to use AI and an extraordinary chemistry team allows us to innovate on the sorbents way more than anybody else,” he said. |

|

Olugbenga Agboola, Founder and CEO, Flutterwave; Robert Bradway, Chairman and CEO, Amgen; Doug Burgum, US Interior Secretary; John Caplan, CEO and Director, Payoneer; Joanne Crevoiserat, CEO, Tapestry; Jacek Olczak, CEO, PMI and more will join the Taking the Pulse of Consumer Confidence session at the 2025 World Economy Summit. As consumer spending drives global economic growth, this session examines how shifting demographics, digital transformation, and economic uncertainty are redefining consumer sentiment and behavior worldwide. April 25, 2025 | Washington, DC | Learn More |

|

The amount Andreessen Horowitz is looking to raise for a megafund investing in US AI startups, in what would be the firm’s largest fund and the third largest behind SoftBank’s Vision funds, Reuters reported. Some international limited partners see the investment as an opportunity to capitalize on American tech with fewer restrictions. |

|

Courtesy of Lightmatter Courtesy of LightmatterA paper published in Nature Wednesday shows how photonic chips — which use light instead of electricity to process information — could one day exponentially increase the amount of compute power available for AI research. Lightmatter, which makes photonic devices that connect today’s AI processors together in massive data centers, built an experimental chip that uses the technology for the processing itself. The paper, co-authored by Lightmatter CEO Nick Harris, details how the chip was able to run powerful large language models using a new method of computation. Today’s AI chips, often called accelerators or graphics processing units, are good at doing the endless matrix multiplication required in enormous AI models by using billions of silicon transistors that each represent either a 1 or a 0. But in the Lightmatter photonic chip, the numbers are represented by an analog light signal that dim and brighten, representing a range of numbers. Only the matrix math is done with photonics (the rest is handled by silicon). But in today’s large, complex AI models, matrix math takes up the bulk of the processing power and energy. The system is still not as precise as electronic-based processing. But it offers huge potential increases in energy efficiency. That could be a big deal in AI where companies are stringing together more than 1 million GPUs and reaching the limits of energy consumption and heat management in data centers. |

|

Demystify AI breakthroughs. MIT Technology Review’s weekly newsletter, The Algorithm, provides digestible insights and expert analysis on the biggest headlines and trends happening in artificial intelligence. Sign up for free today. |

|

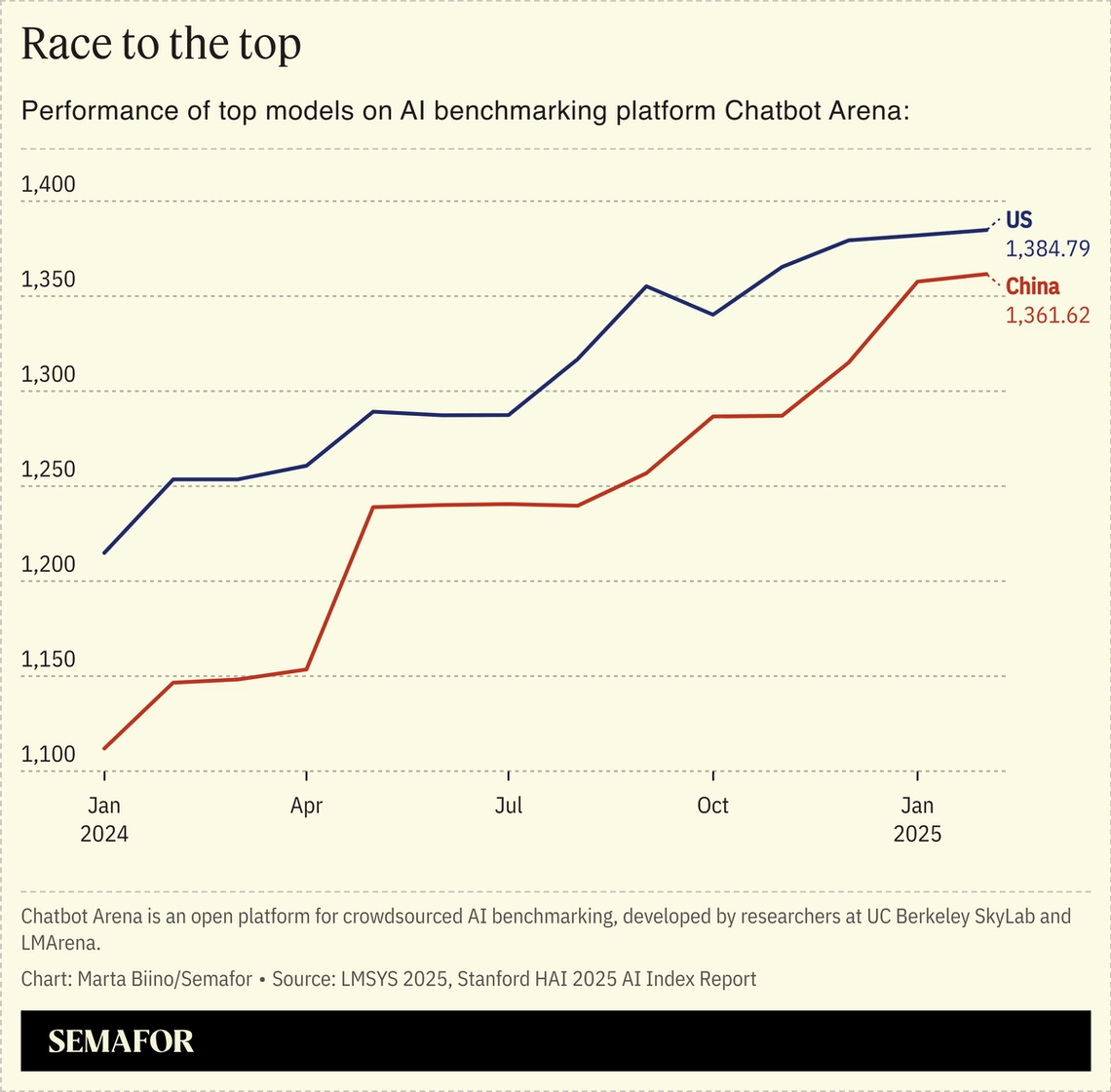

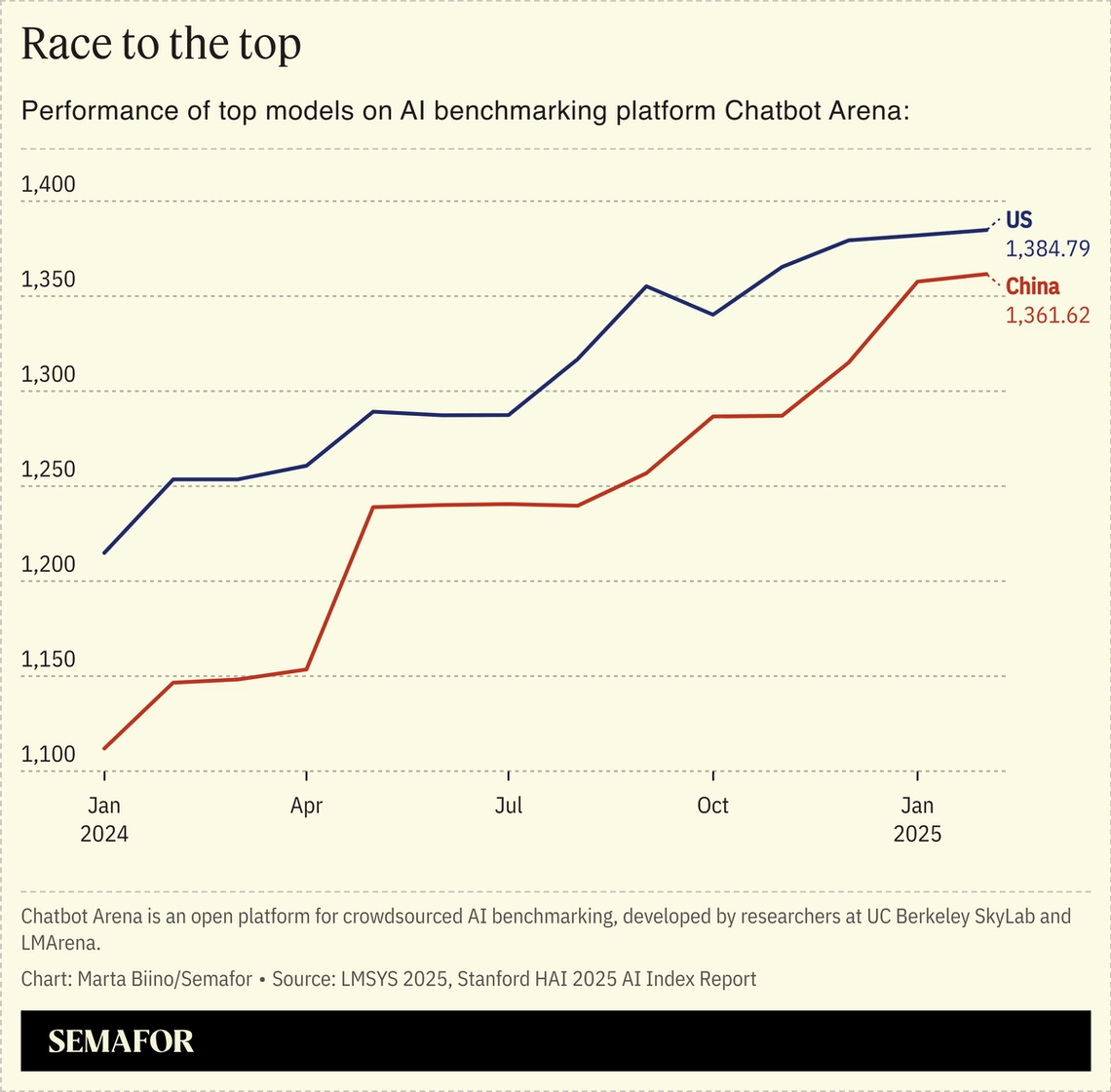

Among the findings in Stanford’s massive AI Index published earlier this week was a revelation that Chinese AI models have gained near parity with US models, according to key benchmarks.  The US still has a lead — both in quality and quantity — of top AI models. And its research is more impactful, though China publishes more research that gets cited more often. What’s telling is that even if AI researchers at US companies make a breakthrough, China will only be a year or two behind. The chip export bans may have slowed China down, but it’s unrealistic to expect it will be all that effective in the long run. The real advantage the US has is not any single AI model or technology, but its overall ecosystem that includes academia, private companies, data center infrastructure and a strong consumer economy. At least for now, US policy has been moving away from that advantage with cuts to research, tariffs on imports, and economic uncertainty that stymies investment. |

|

Christophe Gateau/dpa via Reuters Christophe Gateau/dpa via ReutersTrump’s global trade shakeup has reopened a debate about whether trade deficits are a sign of weakness — or of strength. Semafor’s Liz Hoffman talked to Jason Furman, former chairman of the Council of Economic Advisers under Barack Obama, who argued that trade deficits are actually a “wonderful thing.” “We’re lucky that we’re able to import more than we can export. We get a higher standard of living and more funding for business investment,” Furman said. |

|