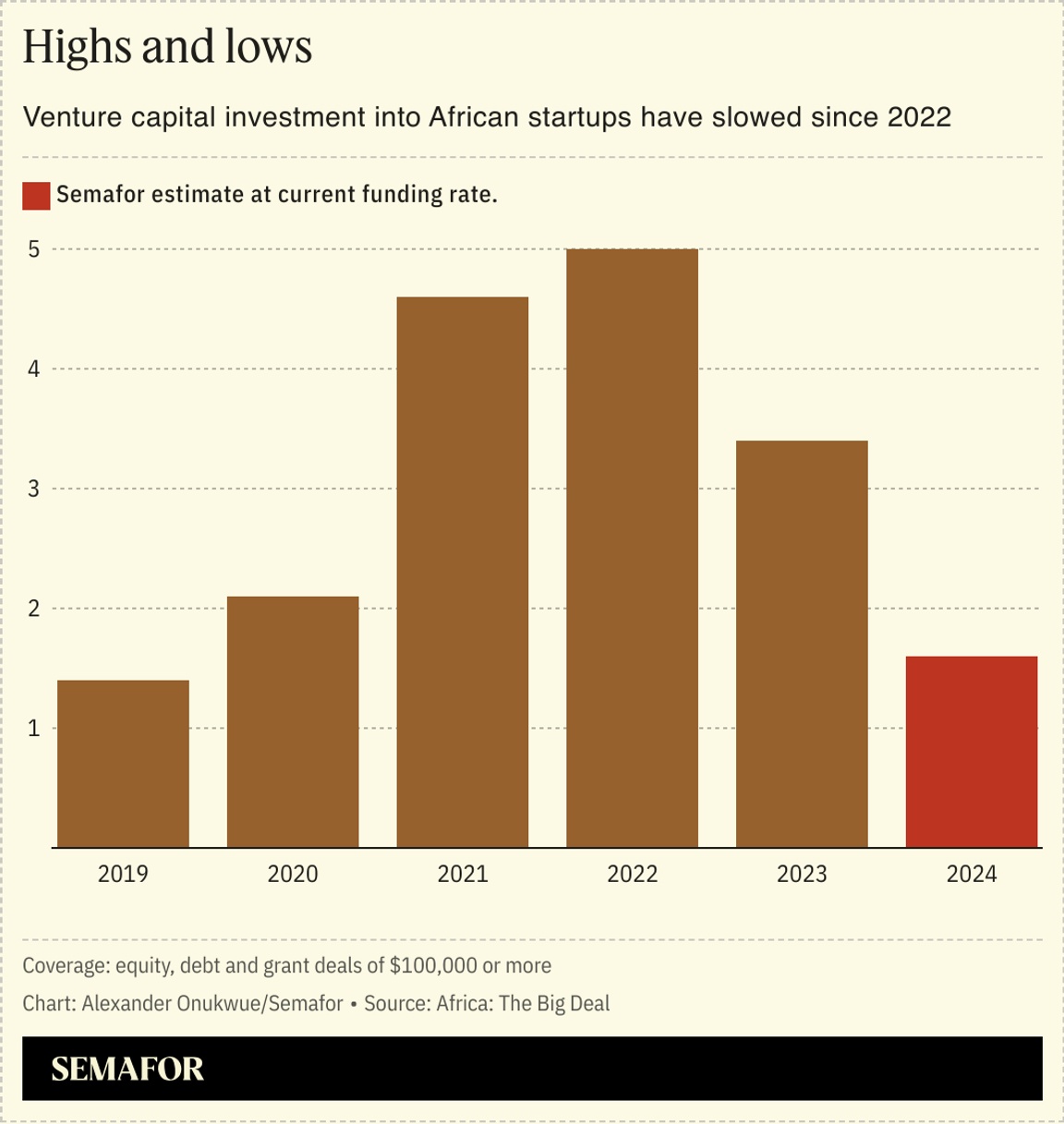

LAGOS — Investors in African startups are increasingly confident of a return to more dealmaking, as the causes of a near two-year pullback by global capital providers fade away. Investments in African startups totaled just $780 million in the first half of this year, down 60% from the same period last year, according to Africa: The Big Deal, which tracks funding data. And in 2023, African startups raised $2.3 billion from equity deals, less than half the year before, and with a simultaneous halving of the number of investors participating in deals, a report by pan-African investor Partech said. But there are signs of macroeconomic stability in Africa’s top destinations for venture capital investment — particularly Nigeria, where the central bank has intervened to calm inflation and currency devaluation. That, plus the prospect of rate cuts by the US Federal Reserve, could boost optimism in the funding ecosystem, some investors say.  The last couple of years have provided African tech hubs with lessons on the need for better structure in making investments, to minimize the potential for startup closures and misdeeds, investors say. “There’s much more optimism in July 2024 than if you were speaking to me in July 2023,” Idris Bello of LoftyInc Capital, who splits time between Cairo, Lagos and the US, told Semafor Africa. “I think we’re seeing this nice plateau where investment capital is coming back in a much healthier ecosystem, with companies that are making real money with real users and a lot less of the froth of the hype cycle,” said Lexi Novitske, general partner at Norrsken22. Before this funding crunch, African tech benefited from the influx of capital from Western investors who took advantage of low interest rates that made borrowing appealing and encouraged investment. A return to low rates, after a year and half of increases up to last July, could spark capital’s revival on the continent. |