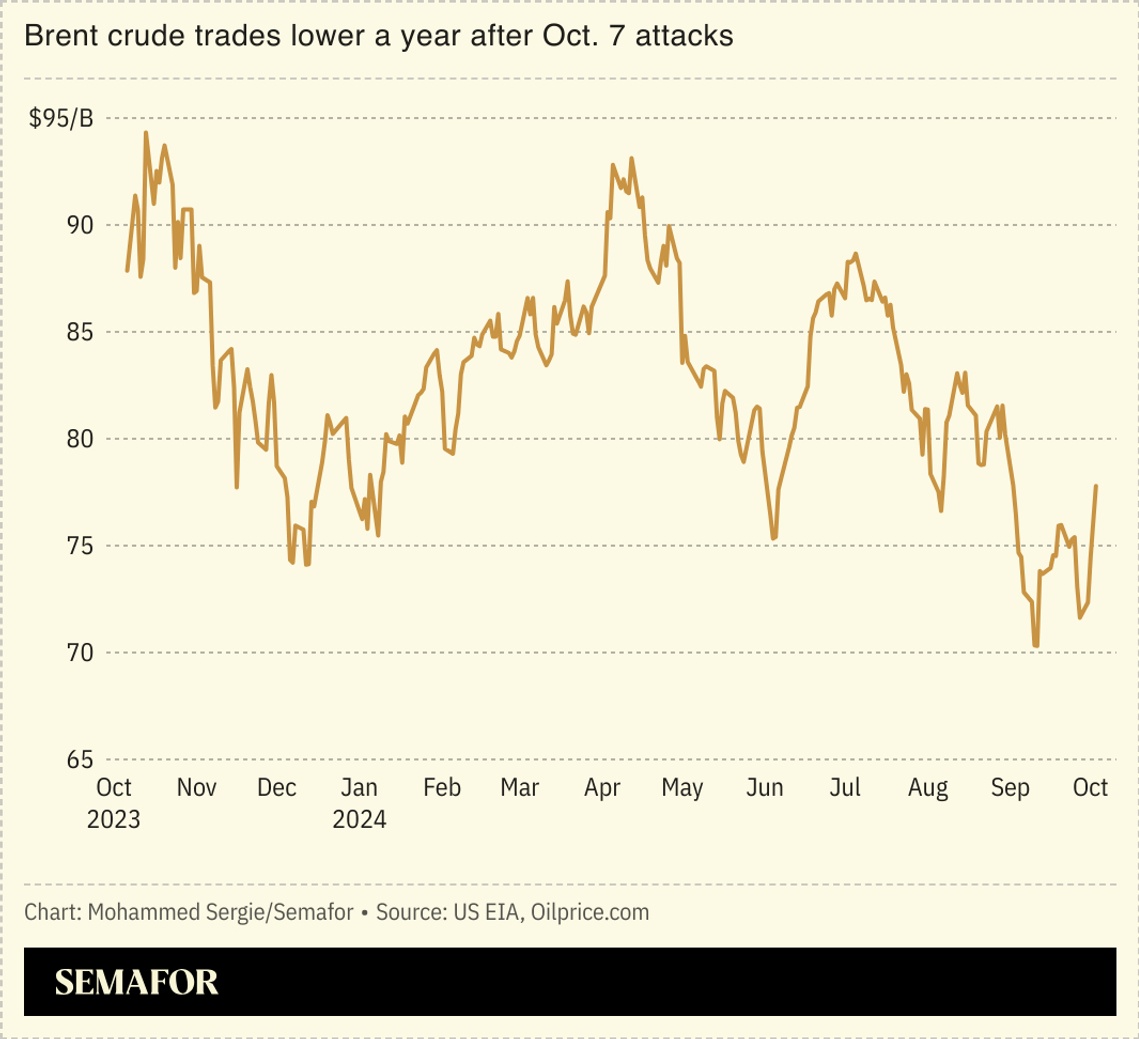

Welcome back to Semafor Gulf. It’s been a year since Hamas fighters went on their rampage, killing more than 1,100 Israelis and prompting a ferocious retaliation that’s left much of Gaza in ruins, more than 40,000 Palestinians dead, and most recently an expanding military operation in Lebanon — with the prospect of all-out war with Iran looming. Israel is consumed with reshaping the balance of power in the Middle East. But beyond a busier diplomatic schedule, higher maritime insurance costs affecting the trade this region relies upon, and the delivery of some humanitarian aid to Gaza, the Gulf has largely been immune to the turmoil. Oil prices — the region’s risk barometer — are lower than they were a year ago. Economies are growing, sovereign wealth is booming, Riyadh is preparing to host the world at Expo 2030 and the 2034 World Cup, and… you get the idea. Gulf countries are watching the carnage, hoping it won’t derail their development plans, and that it results in a new order more stable than the old.  I won’t predict if, and for how long, the Gulf can sidestep this conflict. Early concerns from Saudi Arabia’s crown prince about anti-Israel protests in the kingdom haven’t materialized (as reported in Franklin Foer’s must-read article in The Atlantic on US efforts to support Israel and push it to normalize relations with Saudi Arabia). Despite heated rhetoric, Riyadh, Abu Dhabi, and Doha all agree on calls for ceasefires and a clear path toward Palestinian statehood. Even the US — Israel’s main backer — is seemingly unable to restrain Israel. With Washington’s limited sway and no clear off-ramp for Israel, Gulf countries can only hope that the second year of this conflict is as uneventful for them as the first. |